Writing from Red Fort on Warren Buffett's new investment - UnitedHealth

Initiation Research Report for UnitedHealth

Please consider subscribing to my channel to receive my latest research and articles. Thanks for all the support. You can provide anonymous feedback here. I also welcome your suggestions for stocks or sectors you would like me to cover. This is purely for educational purposes, please check the complete disclosure below.

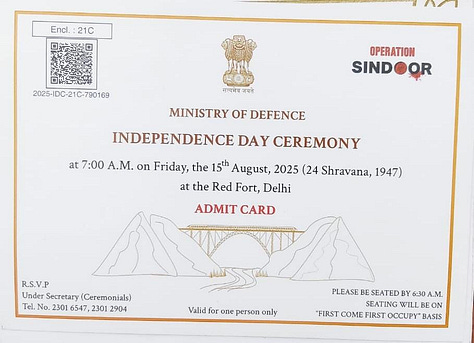

Firstly, apologies for missing the blog yesterday. Last week was India’s 79th Independence Day, and I was at the Red Fort and India Gate to experience the grandeur. The Indian flag hoisting and the national anthem reminded me of my school days. PM Modi gave his longest speech, lasting over 100 minutes. His comments made me ponder and compare India and the US. Having lived and worked in the US during my formative years in my early twenties, American values intrigued me and influenced my Indian values. I contemplated ideas related to capitalism versus a mixed economy, the impact of business and innovation on the economy, the diversity of the Indian subcontinent’s social and cultural aspects, the role of a strong, stable nationalist government at the center, and many more. When I heard patriotic songs like “जहाँ डाल डाल पर सोने की चिड़िया करती है बसेरा, वो भारत देश है मेरा” (where a golden bird resides on every branch, that is my country, India), it made me ponder if India really is the golden bird she once was, and if not, how she can become one again.

Initiation Research Report on UnitedHealth

This is not a blog I am proud of. I acknowledge the research below is sub-par. A company like UnitedHealth, the largest insurer in the US, deserves much more detailed research, probably covering dozens of pages. However, this is a quick one with the key takeaway that the tide is turning, and it might be a good time to buy.

Industry: Healthcare

Sub-Industry: Healthcare Plans

Market cap: $275bn (2:00pm EST, Tuesday)

Current Price: $303

Consensus Target Price: $308

Executive Summary

UnitedHealth saw a change of fortunes last week when it increased significantly after a terrible run this year, having lost a substantial portion of its value.The key news - Warren Buffett’s Berkshire Hathaway initiated a new position of over 5 million shares, valued at more than $1.5 billion, in Q2 2025. What surprises me is that the market is still crazy about what the "Oracle of Omaha" does, even when Berkshire Hathaway's performance has been only marginally better than the index.

This one was a no-brainer, in my opinion. UNH ticks his key filters:

a) It has a narrow moat, as per Morningstar.

b) It was undervalued by the market, with a P/E of around 13x, its lowest in the last 10 years.

And let’s also remember that the action was very sudden. Until mid-April this year, before the Q1 earnings, the share price was ~606 and consensus price target was $635. But poor business performance due to rising medical costs and legal and regulatory headwinds had reduced the target price. There’s a lot to unlock here, and some of it is beyond the scope of this blog. With limited resources, I will cover a bit about their business, key trends, about the recent management changes, followed by its valuation and my position on the stock. I had been buying this since May and its not just Mr Buffett but many hedge fund managers doing the same including David Tepper (Appaloosa), Lone Pine and others. Exact trading dates & proofs are behind paywall.

About the Business

Imagine the ability to influence insured patients to choose in-network hospitals, the ability to influence healthcare providers (by employing doctors in those hospitals), the ability to control which drugs will get reimbursed (thus negotiating with manufacturers), the ability to charge margins on those drugs, and finally, getting paid by the government for running the entire show. This is what UnitedHealth does. They have two business segments: United Healthcare and Optum.

United Healthcare

This is the insurance business, which earns money from premiums in lieu of reimbursing medical costs. A significant portion of its revenue comes from Federal Medicare and state Medicaid programs, with the remainder from private individuals and employers.

Their private insurance includes two segments:

a) Commercial Risk-based – UNH bears the claims risk. It has the potential to grow, however, in the last 2-3 quarters, it has been losing customers.

b) Commercial Fee-based – Employers bear the risk, and UNH earns admin fees for managing operations. They have continued adding new consumers.

However, Public Insurance is much more critical.

a) Medicare Advantage Plans (Medicare Part C) – This is the biggest contributor, where UNH sells insurance to people aged 65+ and takes the claims risk. This segment has been consistently growing.

b) Standardized Supplement (Medigap) – Those seniors who stick with the government plans and buy additional insurance as a top-up come in this bucket.

c) Medicaid – This includes plans for low-income households which are managed by the state.

Medicare Advantage Plans are the biggest of all. Hence, let’s understand that a bit.

How do Medicare Advantage (MA) plans work?

There are millions of Medicare-eligible people (mostly 65 and above). Every eligible person chooses between an MA plan (Part C) versus Medicare by the Government (Part A and B). Medicare by the government gives the freedom to choose any hospital/doctor, i.e., go out of network. But they often require high deductibles and are generally more expensive. Hence, over half choose MA plans, and this number is growing.

The government gives a fixed price to insurers for every person who chooses this plan. Often, such plans are standardized. Companies compete on price, and here Optum gives them the ability to win. Their margins are getting squeezed as the government aims to cut costs in Medicare. And on the other hand, it is one of the major sources of revenue growth.

Keep reading with a 7-day free trial

Subscribe to Himanshu’s Substack to keep reading this post and get 7 days of free access to the full post archives.